5. What else should you think about before investing?

Once you’re clear about the investment powers your charity has and understand your legal duties as a charity trustee, you can start looking at other factors which affect your investment decisions.

As set out in section 4.2, charity trustees have a duty to act with care and diligence so that the investments are in the interests of the charity. This could mean making sure investments are consistent with the charity’s aims. Charity trustees might also link the charity’s investments to its overall strategy, or protection of its reputation.

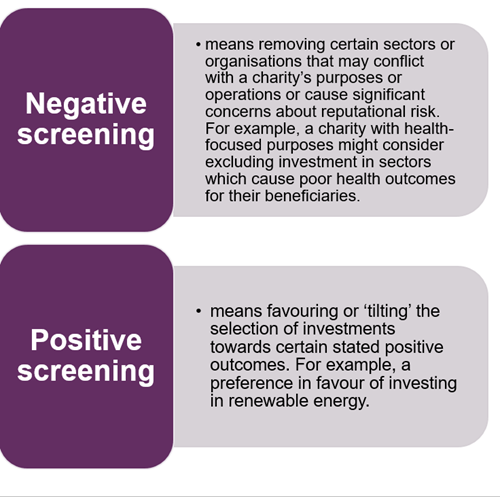

When it comes to screening to align with these aims, here are some examples of the methods that you could use:

Where charity trustees decide to apply some sort of screening on the basis of reputational concerns, they will need to be mindful of the extent to which (if at all) the scope for financial returns narrows as a consequence. Given the legal duties that charity trustees have, it is important that they consider these factors when making investment choices.

|

Myth busting It’s not the case that charity trustees in Scotland have ‘a duty to maximise financial returns’. An investment doesn’t have to make money at any cost. It can provide both financial and non-financial returns but charity trustees have to consider all relevant factors and act in the interests of the charity at all times. |

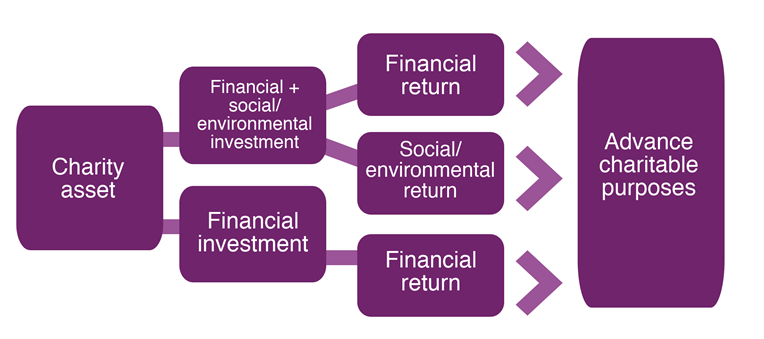

A return from an investment used to mean a purely financial return. However, other investment options are available for charities, including investments that offer a social or environmental return as well as a financial one.

Social or environmental returns can allow a charity to make a link to the delivery of their charitable purposes.

In England and Wales, there is a definition of ‘social investments’ in the Charities (Protection and Social Investment) Act 2016: ‘A social investment is made when a relevant act of a charity is carried out with a view to both directly furthering the charity’s purposes and achieving a financial return for the charity.’

There is no legal definition of social investments in Scotland. It is for a charity’s trustees to assess the suitability of any investment, keeping in mind:

- their investment powers, and

- the general duties to act in the interests of the charity, with care and diligence and in a manner consistent with the charity’s purposes.

Regardless of whether charity trustees decide to apply any negative or positive screening of the kind set out in section 5.1, ESG factors are something to be aware of in the process of making decisions about the charity’s investments.

If a company you are investing in does not take a responsible approach to its impact on the environment, its employment practices or how its board operates, these factors could affect the financial performance of that company. This could affect the value of your investment and/or impact on the charity’s reputation.

Practice varies in the way investment managers approach these factors in selecting investments for your charity. An investment manager may do this as matter of course, or there may be additional options open to you. For more guidance on this, speak to your financial planner or investment manager.

The value your charity chooses to place on ESG factors can be reflected in your investment policy statement (see section 6) and in the kinds of questions you ask of an investment manager during the selection process (see section 7).A further element to consider relates to how any investment manager you appoint uses your investments to influence change on your behalf. This is sometimes known as ‘active stewardship.’

Your investment manager can try to influence change by meeting the companies you are invested in, to influence the management of the company towards better policies or conduct on environmental, social or governance issues arising for that company. For example, this could involve your investment manager meeting the senior management of a company to find out what action is being taken in relation to media reports of poor employment practices. This activity is also called ‘engagement’.

A second element in active stewardship involves voting. Your investment manager is likely to arrange for votes to be cast on your behalf on various matters relating to the company you are invested in. The vote may be for, against, or a decision may be made to abstain.

Practice varies in the way investment managers approach engagement and voting, and the level of information available to you. For more guidance on this, speak to your financial planner or investment manager.

The value your charity chooses to place on active stewardship can be reflected in your investment policy statement (see section 6) and in the kinds of questions you ask of an investment manager during the selection process (see section 7).