7. Implementing your investment policy

Once you have agreed your charity’s investment policy, you’re ready to start investing and this is where professional advice can be key.

Charity trustees need to understand what they are doing with the charity’s money, when it comes to investing. Some charity trustee boards may have the skills and knowledge to manage their own investments. Others will need some professional help and support at various stages of the process.

The type of support that charity trustees may need will depend on:

- the type of assets they are considering investing in

- what their strategy is and

- the complexity of the arrangements that they will be entering into.

If charity trustees are considering seeking professional support, then there are some key points to consider:

- What stage are we at? You may need help thinking through what’s most important to your charity and what your overall strategy should be. Or you may need help developing a strategy or investment policy statement. Many professional advisers and consultants offer help in relation to strategy and policy.

- What kind of assets are we thinking about investing in? Stocks and shares may mean that you turn to an investment manager, financial planner or investment consultant. If your asset is a building, a surveyor or property consultant would be more suitable.

- What returns are we looking for on the investments? If you are seeking non-financial returns, then you might consider support from professionals with a special focus on social investments.

- What support might we need on an ongoing basis? Will you need support to understand how the investments are performing and whether any changes are needed?

Once you have decided what kind of support (if any) you need, the next step is to find the right help. There might be a range of professionals that can help, so you will need to choose the right provider for your charity’s needs.

You might want to invite professionals to give a presentation on the services they can provide or to interview them so you can choose the right service for your charity.

It is a good idea to make a list of your requirements and any questions you have. For example:

- What experience do you have of working with charities like us?

- Which individuals/team would look after our charity and where are they based? Will we be able to contact them if we have questions or concerns about our investments?

- What is your investment proposal for our charity?

- What investment performance could we expect?

- What information will we receive from you, in what format, and when?

- What is the total investment management cost? It is important to understand how much it will cost for the support you want and if the expertise provides value for money.

- What is your approach to ESG and active stewardship?

Once a professional adviser has been chosen by the charity trustees, the arrangement should be formalised so that each party is clear about what is expected and what is to be provided. For example, this could be done in a letter of engagement or investment management agreement.

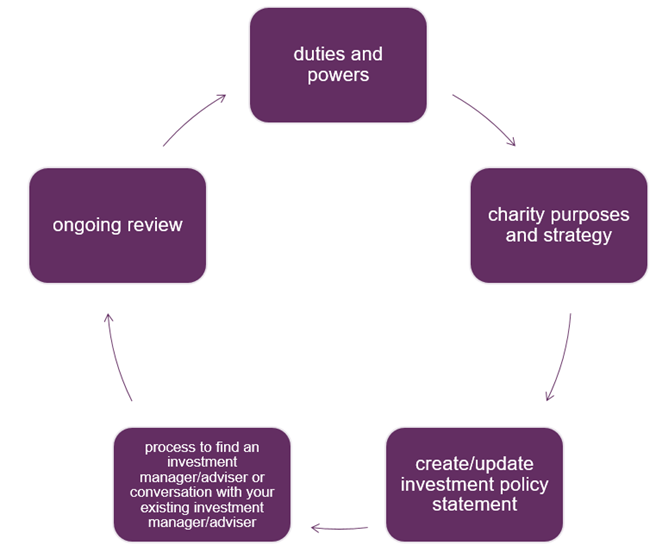

The decisions that charity trustees make about investing the charity’s money are important. These allow the charity to generate financial and non-financial returns for the future and support the charity’s purposes and strategy. However, these decisions are not just made once and then forgotten about – the charity’s approach to investing should be subject to regular review, taking into account changes of circumstances and the environment in which the charity operates.

The charity trustees will want to keep their contract with any professional firm under periodic review. As the charity’s strategy evolves over time, charity trustees need to ensure that its investment policy keeps pace, and that its investments are continuing to support the charity’s goals. Concerns over service or value for money may also prompt a review, for example.

The following case studies share examples of how different charities approached their investments.

Case study 1

This case study sets out how one charity approached a review of its investments. The charity’s assets included an investment portfolio worth under £1M.

The charity trustees carried out a skills audit to help flag any skills gaps on the board. This identified that there wasn’t a charity trustee with any investment experience currently on the board. A recruitment exercise was carried out and a new charity trustee with investment experience joined the board and also became a member of the Finance Committee.

Historically, the charity did not have an investment policy statement. The new charity trustee identified this gap and the Finance Committee was tasked with preparing a draft for consideration by the board. This was done, and the board reviewed and adjusted the investment policy statement, before approving it.

The investment policy statement contained ethical screening requirements, which were discussed by the Finance Committee and also the board of charity trustees. Tobacco, weapons manufacturing and pornography were excluded as sectors which caused harm to the beneficiary population of the charity or which caused significant reputational risks for the charity.

The Finance Committee developed a list of questions to ask investment managers, and a number of investment managers were invited to submit a tender. The investment policy statement was sent to investment managers along with the list of questions. A sub-group of the Finance Committee then attended presentations by the shortlisted investment managers. The Finance Committee made a recommendation to the board of charity trustees on which investment manager should be appointed. The board discussed and accepted this recommendation. The process to transfer the funds over to the new investment manager took several months.

On an ongoing basis, investment valuations are made available before Finance Committee meetings, and an online valuation service is also available. The investment policy statement is kept under review by the Finance Committee, and has since been further revised and approved again by the board of charity trustees.

Case study 2

This charity reviewed its investment portfolio following a specific process. Due to the background and sector in which the charity operates, the public procurement process was followed, in line with EU rules which lead to online notification of contracts for tendering.

The board of charity trustees sought advice from an investment consultant, to assist in identifying their requirements and to take advice on what investment approach would meet their goals. The investment portfolio was valued at seven figures.

From the many proposals submitted in response to the invitation to tender, a shortlisting exercise was completed. Investment managers were invited to meet a sub-group comprising some charity trustees, finance staff of the charity and the external investment consultant. In this way, an investment manager was identified and appointed.

Case study 3

A charity established with an initial endowment of £150,000 decided to invest into an ethical fund that is managed externally.

The charitable purpose is to assist Scottish communities, particularly rural communities, to find ways to work with the principles of sustainable development. One of the main activities is organising conferences that explore different aspects of rural development.

In 2014, the charity took a decision to invest £10,000 via the purchase of community shares in a Community Benefit Society (BenCom) involved in the field of community renewables. The investment was for a minimum period of three years and offers 3% - 4% return.

The charity trustees considered the community share investment to be more at risk than the funds placed with their ethical fund. Equally, they recognised that the financial return was also less certain.

However, the charity trustees agreed to invest in the community share offer because they believed that it fully aligned with their charitable purpose. It was also an opportunity for the charity to make a direct investment in a local project, the broad aims of which were also entirely consistent with the interests that the charity wishes to promote. Importantly, although not an overriding consideration, the investment was considered to offer a fair rate of return, although was likely to be significantly less than that generated from the ethical fund.

As this is a community share offer, the charity currently receives an annual dividend of approximately 3-4%. Under BenCom rules, after the three-year period, the capital value of the investment can be redeemed at the discretion of the BenCom and with the agreement of the investor. Due to the success of the community renewables venture, it is anticipated that the BenCom will be in a position to repay capital investments in the forthcoming years in order to reduce its debt repayments. In that case, the charity, which is interested in the long-term sustainability of the renewals BenCom, is likely to agree to the redemption offer, even though the level of financial return has proved to be satisfactory.

The community share investment offered the charity an opportunity to invest locally and to be more ‘productive’ with its money. As a result, the charity now considers itself more likely to invest ‘socially’ although also with an eye to securing a reasonable financial return.

Case study 4

An education charity holds an endowment. Its mission includes a commitment to make a positive impact for society and to make a significant sustainable and socially responsible contribution to the world. The charity is translating this commitment across its activities, including its endowment and treasury funds. It has a long-standing responsible investment policy, which includes the following four elements:

- The charity is committed to ESG integration, which means ESG factors are embedded in the research and investment process which underpins its investments. The charity is also a signatory to the UN Principles for Responsible Investment (as are its chosen investment managers).

- It applies negative screening and won’t invest in tobacco, controversial weapons or fossil fuels companies.

- The charity has undertaken positive investments in low carbon and renewables.

It has committed to significant social investments, including an investment in a social fund which provides early stage finance to support local social enterprises.