What a trustees' annual report needs to include

There are legal requirements as to the minimum information that needs to be included in the TAR. However, there is flexibility over the way it can be presented and freedom for charity trustees to provide more detail or explanations, if they think this could be helpful for readers.

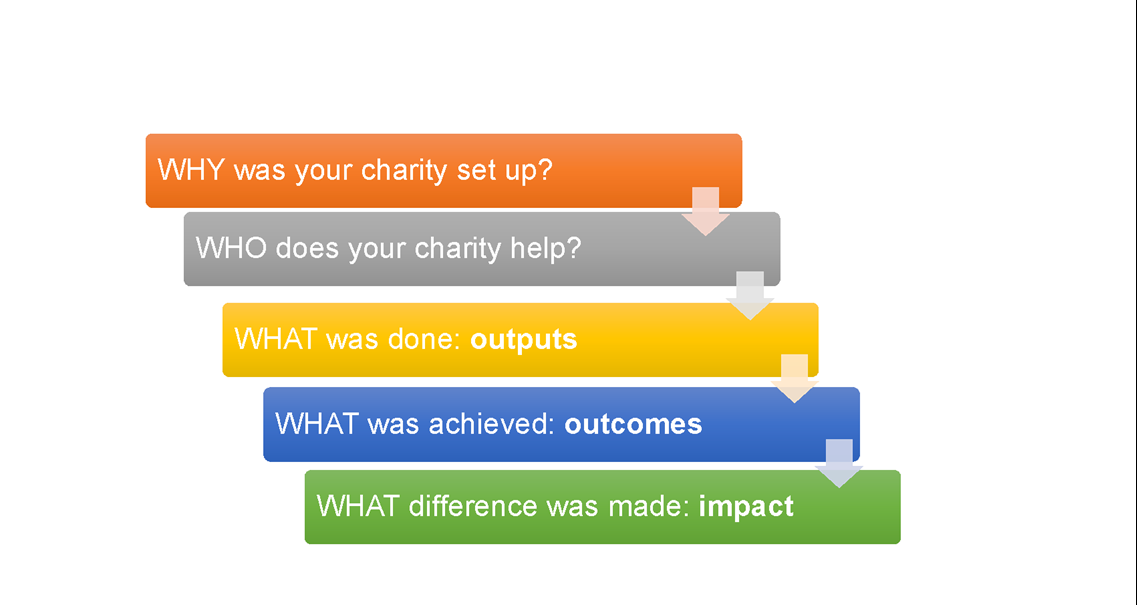

Charity trustees need to think about how best to present the information to their audience. Graphs or pictures may help with telling the story and engaging readers of the report.

For example, some charities use charts to show how their income has been spent and how users have benefited from the services provided.

TARs should be eye catching and easy to understand. They should cover the following key concepts: Before you start your TAR you need to know which type of accounts you need to prepare. The type of accounts will determine what information you must include:

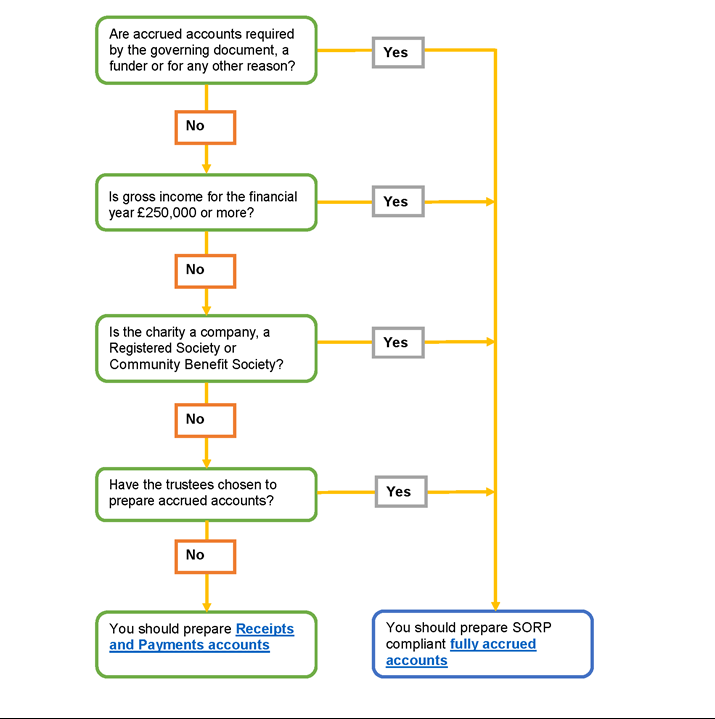

Before you start your TAR you need to know which type of accounts you need to prepare. The type of accounts will determine what information you must include:

- use the flowchart to decide what type of accounts you need to prepare

- then click on the appropriate drop down to see what information you must include in your TAR.

Download the pdf version of the flowchart.

The Charities Accounts (Scotland) regulations 2008 set out the requirements for the TAR for charities preparing receipts and payments accounts. These accounts can be prepared by all non-company charities whose gross annual income is less than £250,000 and where there is no requirement within the charity's governing document or by funders to prepare accrued accounts.

|

Legal Requirement |

What does it mean? |

|

Charity name |

The name of the charity as it appears on the Scottish Charity Register. |

|

Charity number |

This is the unique number given to all Scottish charities, beginning with SC0 (zero) followed by five numbers. |

|

Charity’s principal address |

The address of the principal office of the charity. Where the charity does not have an office, the name and address of one of the charity trustees must be included, unless the charity is entitled to exclude the address from its entry in the Register because of safety concerns (decided by OSCR). |

|

Names of the charity trustees on date of approval of Trustee’ Annual Report |

The names of all the charity trustees on the date the annual report was approved unless:

|

|

Names of all other charity trustees |

The name of anyone else who has been a charity trustee during the financial year covered by the accounts the annual report forms part of, unless the charity is entitled to exclude the names because of safety concerns (decided by OSCR). |

|

Type of governing document |

A charity’s governing document will state its purposes, set out how the charity operates and what activities it can undertake. It may be in the form of one document or several documents. For a Trust it will be the Trust Deed, other charities may simply call it a Constitution. |

|

Trustee recruitment and appointment |

A description of how the charity trustees are recruited and appointed, including the name of any external organisation that is entitled to appoint charity trustees (for example, a parent body or local authority). |

|

Charitable purposes |

A summary of the purposes of the charity from its governing document. The purposes are what the charity is set up to achieve and can also be found on the charity’s entry on the Scottish Charity Register. |

|

Summary of the main activities and achievements of the charity |

A description of the main activities that the charity is undertaking to achieve its purposes. This should give anyone reading the accounts a clear understanding of the activities of the charity and how these further the purposes of the charity. The charity should clearly state what it has achieved through its activities. |

|

Policy on reserves |

Details of the charity’s reserves policy. See our Charity Reserves Factsheet for more information. |

|

Details of any deficit |

If a deficit (where the charity has spent more than it received in the financial year) is shown in the accounts, the charity trustees should provide information about how this happened and, if appropriate, what steps are being taken to rectify it. |

|

Donated services and facilities (does not include donated goods for resale) |

Many charities will benefit from services or facilities which are donated to them. These will not appear in receipts and payments accounts but information about the value of these donated services or facilities should be included in the TAR to allow readers to understand the value that has been contributed to the charity. |

The Charities Statement of recommended Practice (SORP) sets out the requirements for the TAR for charities preparing fully accrued accounts. Under SORP if you have an income under £500,000 you need to include the following:

|

Legal Requirement |

What does it mean? |

|

Charity name |

The name of the charity as it appears on the Scottish Charity Register plus any other name that the charity uses. |

|

Charity number |

This is the unique number given to all Scottish charities, beginning with SC0 (zero) followed by five numbers. Where the charity is also a company, the company registration number must also be given. |

|

Charity’s principal address |

The address of the principal office of the charity. Where the charity does not have an office, the name and address of one of the charity trustees must be included, unless the charity is entitled to exclude the address from its entry in the Register because of safety concerns (decided by OSCR). Where the charity is also a company, the company’s registered office must also be given. (This cannot be excluded on the grounds of safety). |

|

Names of the charity trustees on date of approval of Trustee’ Annual Report |

The name of all the charity trustees on the date the annual report was approved. Where a charity has a corporate trustee, names of the directors of the corporate body on the date of signature. Names of any trustee for the charity holding the title to property belonging to the charity on the date the report was approved or at any time during the year. The above information is not required where the charity is entitled to exclude the names because of safety concerns (decided by OSCR). |

|

Names of all other charity trustees |

The name of anyone else who has been a charity trustee (including those who served as a trustee for the charity in holding the property) during the financial year covered by the accounts the annual report forms part of, unless the charity is entitled to exclude the names because of safety concerns (decided by OSCR). |

|

Type of governing document and details of how the charity is constituted |

A charity’s governing document will state its purposes and set out how the charity can operate and what activities it can undertake. It may be in the form of one document or several documents. For a Trust it will be the Trust Deed, other charities may simply call it a Constitution. Charities should include details of how they are constituted such as limited company, unincorporated association or SCIO. |

|

Trustee recruitment and appointment |

A description of how the charity trustees are recruited and appointed, including the name of any external organisation that is entitled to appoint charity trustees (for example, parent body, local authority). |

|

Charitable purposes and activities |

A summary of the purposes of the charity from its governing document. The purposes are what the charity is set up to achieve. A description of the main activities that the charity is undertaking to achieve its purposes. This should give anyone reading the accounts a clear understanding of the activities of the charity and how these further the purposes of the charity. |

|

Summary of the main achievements of the charity |

The charity should clearly state what they have achieved through their activities. This should identify the difference the charity’s work has made to the circumstances of its beneficiaries and, if practicable, explain any wider benefits to society as a whole. |

|

Financial review |

The report must explain the financial position of the charity at the end of the year. The financial review should be consistent with the figures in the accounts. |

|

Policy on reserves |

Details of the charity’s reserves policy. See our Charity Reserves Factsheet for more information. |

|

Details of any deficit |

If a deficit (where more has been spent than received) is shown on any fund the charity trustees should provide information about how this happened and what steps are being taken to rectify it. |

|

Details of any going concern uncertainty |

If there is any uncertainty over the ability to continue as a going concern then this should be explained. Going concern means that the charity will continue with its activities for at least, but not limited to, 12 months from the date the accounts are approved unless the charity trustees intend to wind it up or have no other option. |

If your charity has an income of more than £500,000 there are also additional requirements for your TAR. Please refer to module 1 of the Charities Statement of Recommended Practice for more information.